Provisional Measure changes PIS and COFINS calculation rule of companies

The government has issued Provisional Measure 1159/23, which removes from the PIS calculation base and the contribution to social security financing (Cofins), two federal taxes, the value of ICMS (state tax) embedded in goods or services.

Provisional measure changes devices of tax laws 10.637/02 and 10.833/03 . The government states that the new rule follows an understanding signed by the Federal Supreme Court (STF) in a trial in 2017, definitively completed in 2021.

until then, the IRS considered that the ICMS built into the products sold would integrate companies' revenues, on which the value of the PIS/Cofins is calculated. However, the Supreme Court understood that the tax is a revenue from states, not taxpayers. Thus, the ICMS portion could not be understood as company revenues.

credits

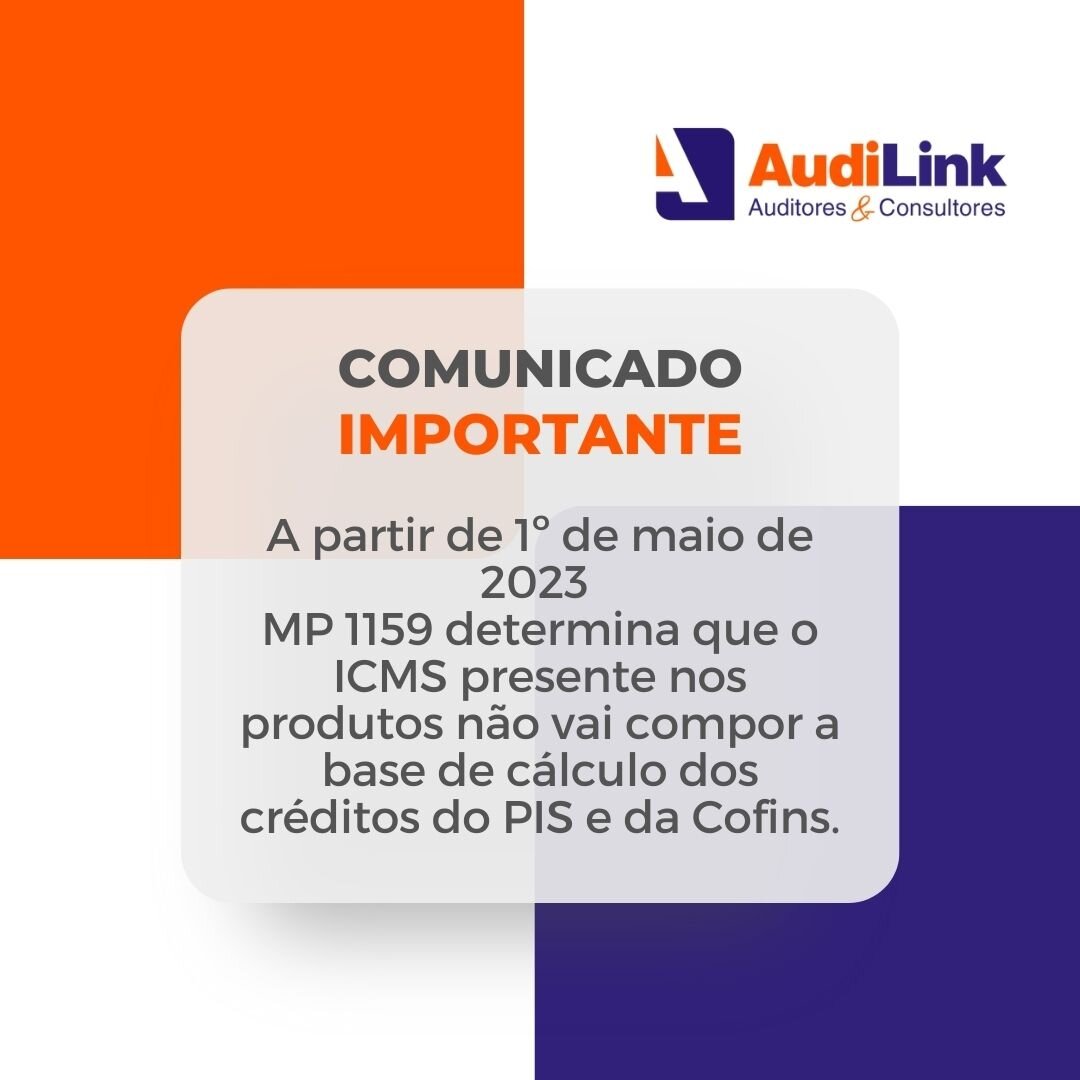

MP 1159 also determines that the ICMS present in the products will not compose the base calculation of PIS and COFINS credits. This measure is valid from May 1, 2023.

Tax credits represent more paid taxes along the production chain that can be returned to the taxpayer or used to deduct other taxes. The practical effect of the change provided for in MP is that companies will be less entitled to tax return.

Source: Agency Chamber of News